• Portfolio appreciation. When the industry worth of a mutual fund’s Over-all portfolio rises, the value in the fund’s shares increases. Gains in NAV of a mutual fund replicate the upper price of your mutual fund shares.

Numerous financial investment professionals suggest their clients to variety into an array of securities as opposed to focusing on just a few stocks.

Mutual money give Added benefits to buyers by offering them a protected and diversified portfolio of investments. They deliver returns for shareholders by using:

The online asset price (NAV) is really a critical metric applied to ascertain the worth of the expenditure fund. It represents the for every-share value of the fund's property following deducting its liabilities. The NAV is calculated by dividing the overall price of the fund's assets by the volume of shares excellent.

Commodities: Inflationary environments can lead to a rise in the costs of specific commodities, building them a good asset course to use being an inflation hedge.

The Vanguard name is synonymous with very low costs, meaning that much more of your investment goes to the bonds, not into your fund professionals’ pockets.

Examining account guideBest examining accountsBest no cost examining accountsBest on line check accountsChecking account alternate options

Mutual resources really are a sort of open up-finished financial investment fund that pools funds from a number of traders to speculate in a diversified portfolio of securities.

You always want to minimize the fees you spend, given that they consume into returns. Even seemingly modest costs may result in significant modifications in long-time period returns, owing to compounding.

This experience can probably direct to higher expenditure returns when compared to unique buyers who may lack some time, means, or expertise to research and choose individual securities.

Morningstar classifies RPMGX as reduced danger with better returns than its class regular. RPMGX is well worth weighing by Buyers who want the growth of mid-caps with a lot less volatility compared to fund’s classification.

[eight] Provenance also is typically called custodial historical past as it will take in account more info the different individuals or corporations that held these documents previous to the archive acquiring them and the way in which they organized them.[nine] Regard des fonds is usually confused as being similar to provenance, but the two Suggestions, although intently relevant, are distinct in that provenance refers to maintaining is effective by precise men and women or corporations as individual from Other individuals, while regard des fonds adds to this by also protecting or recreating the initial order of your creator. The Concepts of fonds and respect des fonds remodeled the archival globe, and are still in use right now.

The very best index resources will let you Develop prosperity by diversifying your portfolio though reducing your costs. Investing in an index fund is less dangerous than investing in person shares or bonds for the reason that index cash usually hold hundreds of monetary securities.

In which to order corporate bonds: Comparable to authorities bonds, you can buy corporate bond resources or unique bonds as a result of an financial investment broker.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Michael Fishman Then & Now!

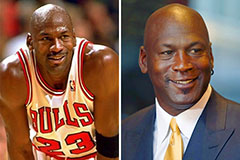

Michael Fishman Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Kane Then & Now!

Kane Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!